- +7 (995) 067-6400

- Kirov, Russia, 610000

- info@russianconsultants.com

Taxes in Russia: Overview

Whether you are going to start a business in Russia, invest or relocate to Russia, taxation is one of the most important things to consider. Individual and corporate tax rates in Russia are lower than in many EU countries, and choosing the right taxation system will help you save a great deal of money.

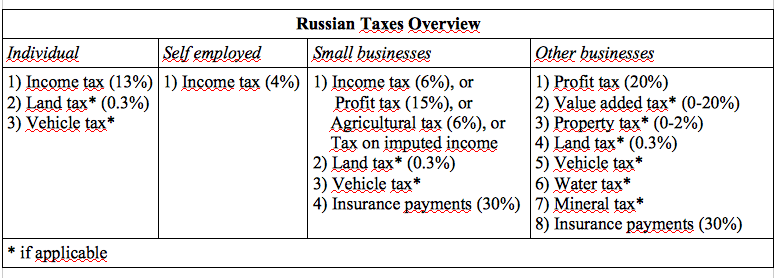

Individual taxes

All Russian residents are expected to pay a personal income tax. The rate is flat and amounts to 13 per cent. If your annual income exceeds 5 million Rubles, the income tax rate will be 15 per cent. Personal income tax in Russia is automatically deducted from employee's salary by the employer with no further actions required. If the income comes from other sources than salary (for example, from renting out an apartment), it should be declared to the Tax Service by 30 April of the year following the year the income was received in.

Self-employed persons (like teachers, translators, programmers, etc.) may enjoy even better tax rate: after registering with the Tax Service their tax rate will be just 4-6 per cent.

Dividend tax rate in Russia amounts to 13 per cent for residents and 15 per cent for non-residents (i.e. for those spending in Russia less than 6 months out of 12).

Land owners in Russia are expected to pay a land tax. The rate is set by local councils, but it can't exceed 0.3 per cent of the cost of agricultural and residential lands. The cost is calculated by cadastral engineers with special formulas and is usually far lower the market price. For example, Russian land tax for a standard residential land plot will be just about $15-50 annually.

Finally, motor vehicle owners are expected to pay an annual vehicle tax. The rate is set by regional governments and depends on the car's engine power amounting to $0.2-2 per hp.

Corporate taxes

Russian small businesses are eligible for simplified corporate taxation. If a company has less than 100 employees and its income is below 150 million rubles (about $2 million), it can choose to pay one of the following corporate taxes:

- 6 per cent corporate income tax which is to be paid for any income, or

- 15 per cent corporate profit tax which is to be paid for the difference between income and expenses.

The company can choose any of these two options, and the tax should be paid every 3 months.

Instead of the simplified corporate taxation, all farmers in Russia are eligible for a unified agricultural tax which has a flat rate of 6 per cent.

Russian companies working in retail, advertising, transport and some other spheres may choose to pay a tax on imputed income. It doesn't directly depend on the actual income and may be even more befecial than a simplified corportate tax. It is better to opt for this tax after consulting with your tax advisor.

If you choose a simplified corporate tax, a unified agricultural tax or a tax on imputed income, no other taxes (except a land tax and a vehicle tax if applicable) should be paid.

If the company doesn't fall in one of the categories described above (usually medium or large businesses), it should pay several corporate taxes: a profit tax (20 per cent), a value added tax (0-20 per cent), a property tax (0-2 per cent of the property cost calculated with a special formula). In some special cases a water tax and mineral tax may apply.

Insurance payments

In addition to taxes, Russian businesses are expected to make insurance payments for their employees. The rates are linked to their salaries and amount to: 22 per cent for pension insurance, 2.9 per cent for social security insurance and 5.1 per cent for medical insurance. For example, if an employee has a salary of 50,000 Rubles, the company should make the following payments:

- 43,500 Rubles to the employee (salary minus income tax),

- 6,500 Rubles to the Tax Service as employee's income tax,

- 15,000 Rubles to the Tax Service as insurance payments for the employee (22+2.9+5.1=30 per cent).

How to pay taxes

All tax and insurance payments in Russia should be made to the Federal Tax Service. Most taxes can be paid online at their website www.nalog.ru. Individual taxes can be paid at public services website www.gosuslugi.ru.

Please note that this article describes Russian general taxation procedures. Additional regulations may be applicable in some cases. You are welcome to contact our professional tax advisors regarding your specific case.