Personal taxes in Russia

On average Russian residents pay far less taxes than American, British or EU citizens. Most Russians pay just a 13 per cent personal income tax. If your annual income exceeds 5 million Rubles, the income tax rate will be 15 per cent.

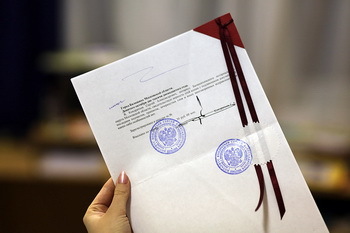

Personal income tax in Russia is automatically deducted from employee's salary by the employer with no further actions required. If the income comes from other sources than salary (for example, from renting out an apartment), it should be declared to the Tax Service by 30 April of the year following the year the income was received in.

Russian residents and citizens who are registered as self-employed (like teachers, translators, IT engineers) enjoy an even better income tax rate which is just 4-6 per cent.